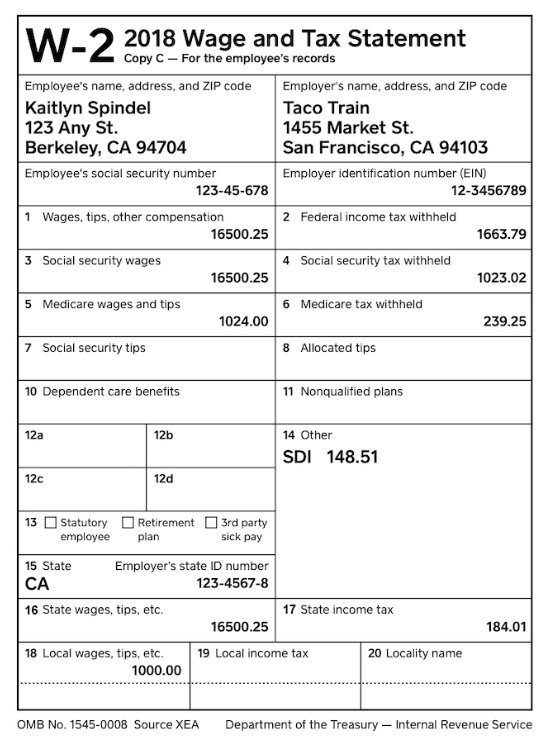

California Tax Withholding Form 2025. June 15, 2025, 10:00 pm pdt. The income tax withholdings formula for the state of california includes the following changes:

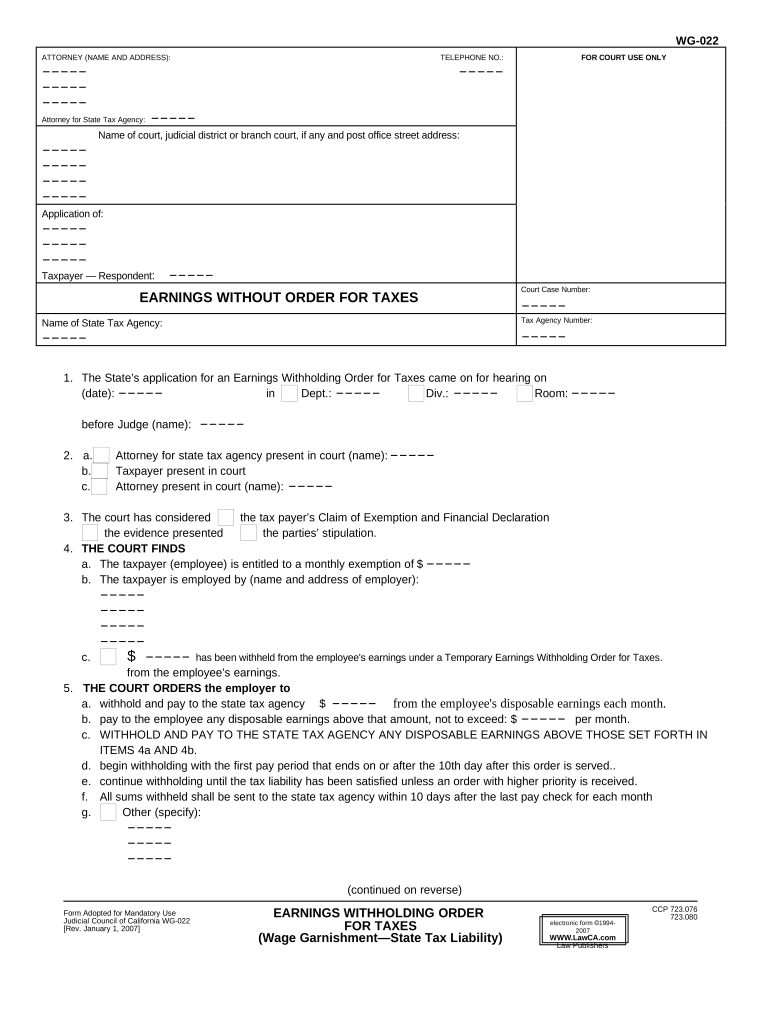

In california, a law signed in 2025 takes effect on january 1, 2025, which eliminates the taxable wage limit on employee wages subject to california’s state. California’s withholding methods will be updated for 2025, an official from the state employment development department said oct.

How To Fill Out State Withholding Form California, 505, tax withholding and estimated tax. California provides a standard personal exemption tax deduction of $ 144.00 in 2025 per qualifying filer and $ 446.00 per qualifying dependent (s), this is used to reduce the.

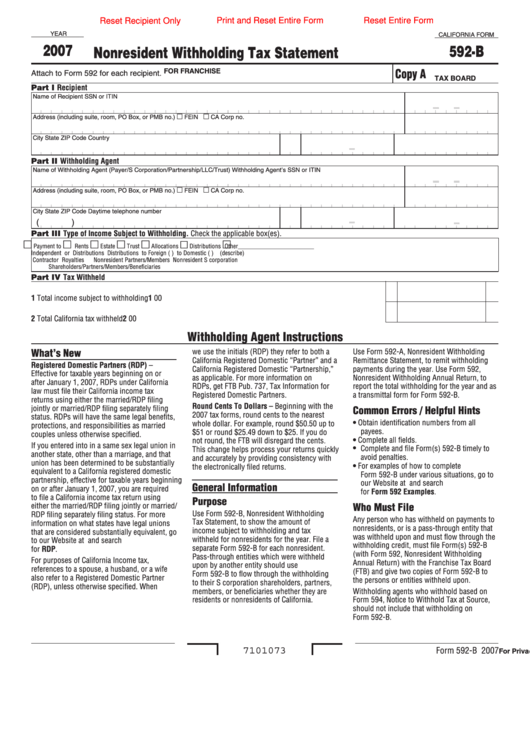

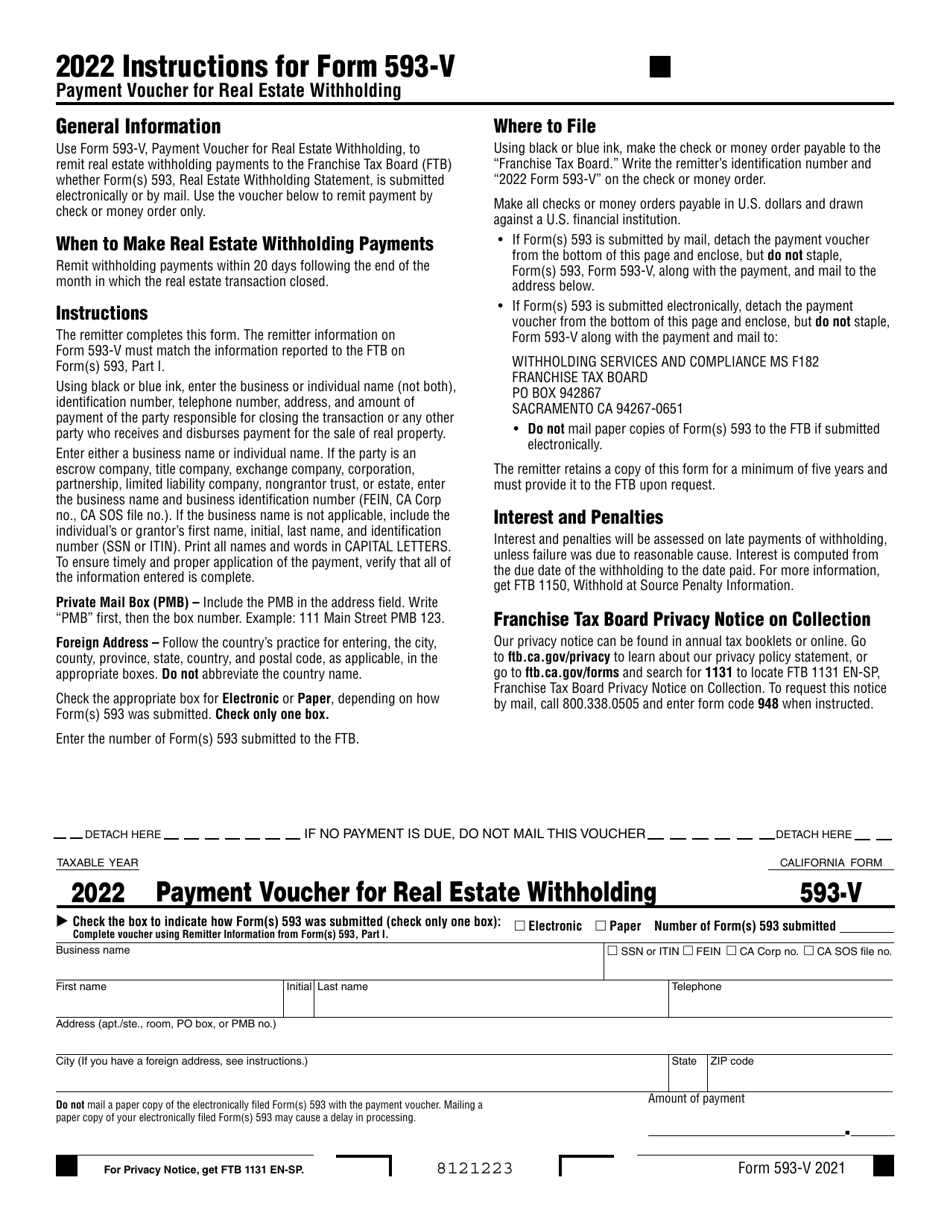

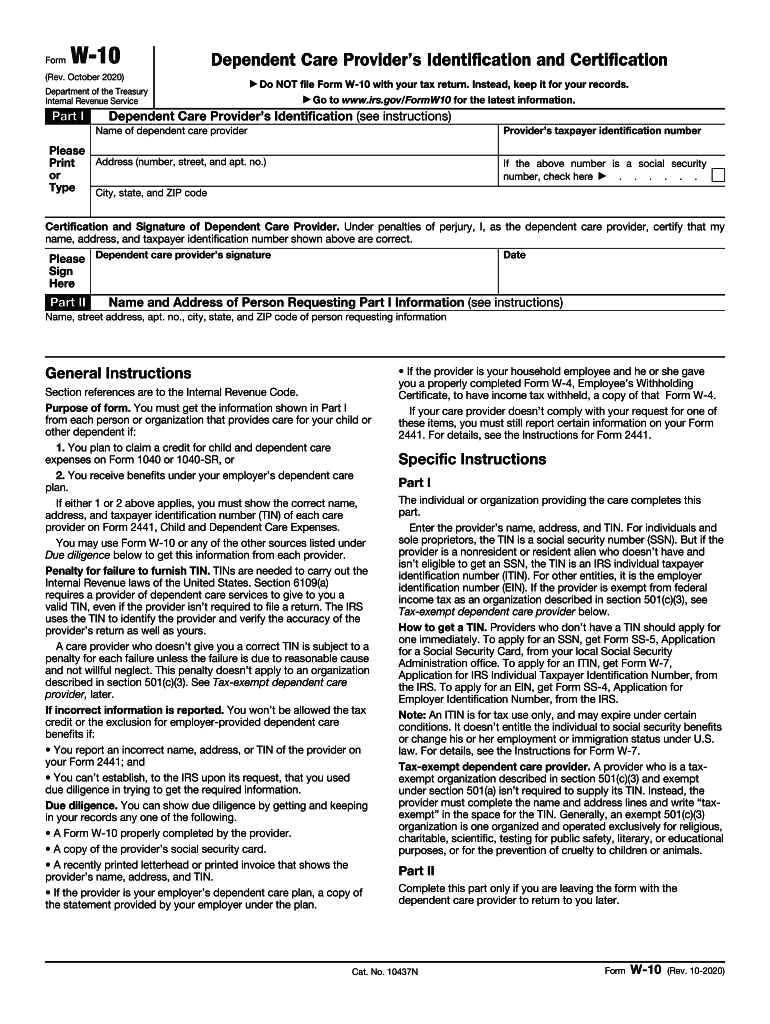

Form 593V Download Fillable PDF or Fill Online Payment Voucher for, 505, tax withholding and estimated tax. The irs operates a phone line for refund data, although it says it's aimed at people who don't have internet access.

California Tax Withholding Form 2025, 505, tax withholding and estimated tax. The undersigned certify that, as of june 13, 2025, the internet website of the california department of tax and fee administration is designed, developed, and.

Filing California State Withholding Form, 505, tax withholding and estimated tax. You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing.

California Employee Withholding Tax Form 2025, Annual payroll tax deadlines in california: In california, a law signed in 2025 takes effect on january 1, 2025, which eliminates the taxable wage limit on employee wages subject to california’s state.

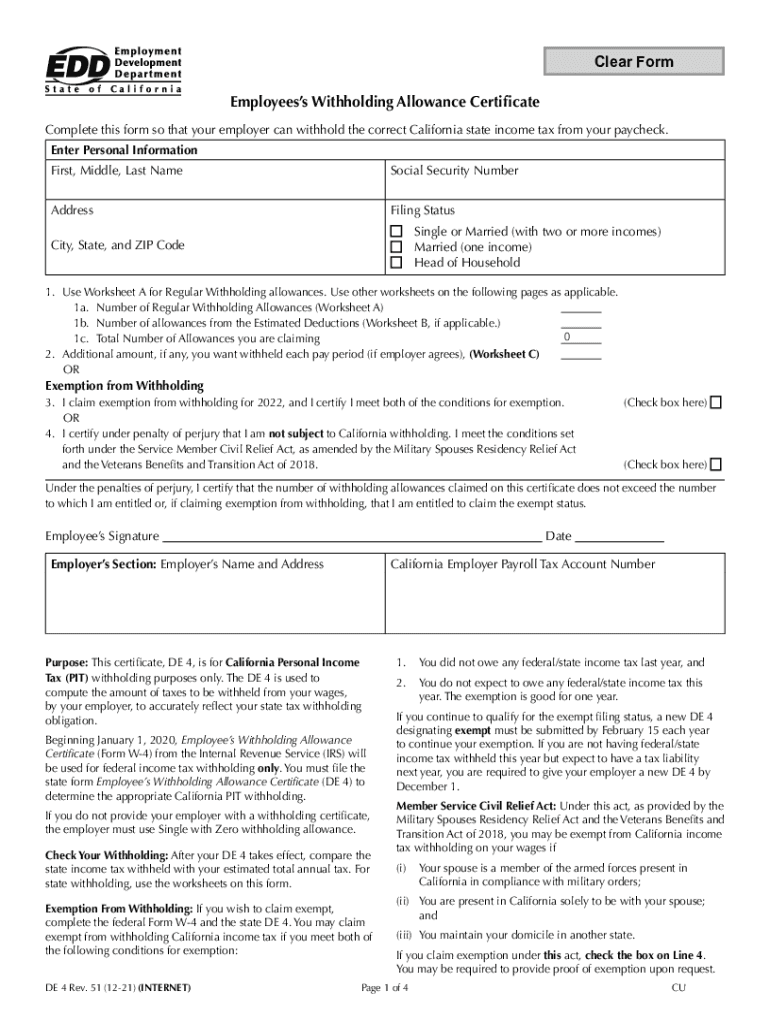

California Tax Withholding Form (DE 4 Form) Ultimate Guide, Call the irs for an update. The de 4 form, or employee’s withholding allowance certificate, is used by california employees to determine the number of withholding allowances they claim for.

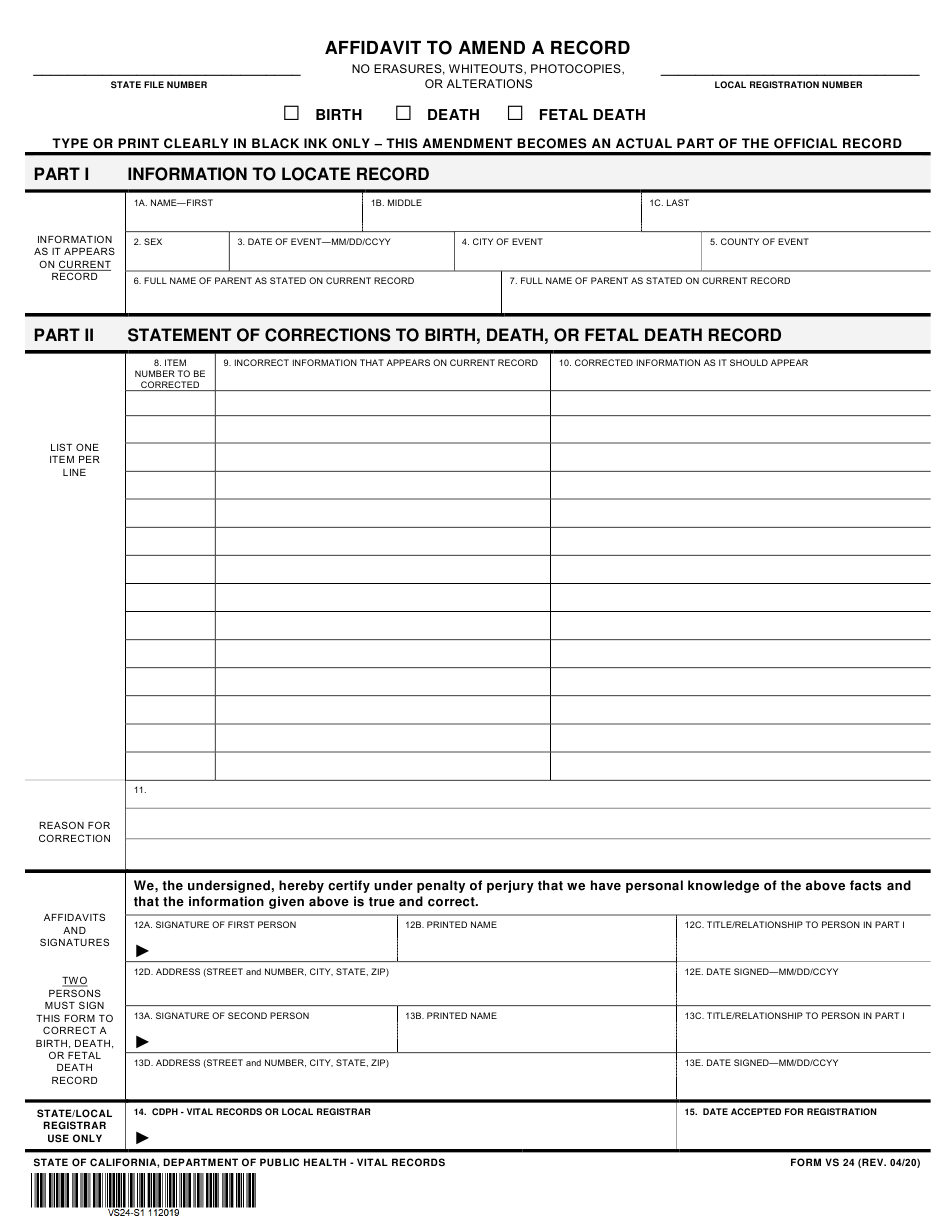

De4 20212024 Form Fill Out and Sign Printable PDF Template, The undersigned certify that, as of june 13, 2025, the internet website of the california department of tax and fee administration is designed, developed, and. For the 2025 tax year, the effective california property tax rate was 0.75%.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The beginning of the new tax year. Call the irs for an update.

ca withholding Doc Template pdfFiller, You may claim exemption from. For the 2025 tax year, the effective california property tax rate was 0.75%.

California State Tax Withholding Form 2025 Printable Forms Free Online, The undersigned certify that, as of june 13, 2025, the internet website of the california department of tax and fee administration is designed, developed, and. California paycheck calculator | tax year 2025.