Ally Auto Loan Rates 2025. Finance amount must be between $1,000 and $300,000. When auto approve and ally, there are more similarities than differences.

The average new car loan rate now sits at 9.58% — “the highest we’ve seen for more than 20 years.” the average used car loan rate sits higher at 13.98%. Flexible terms for virtually any.

We reviewed 16 popular auto loan lenders based on 16 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience.

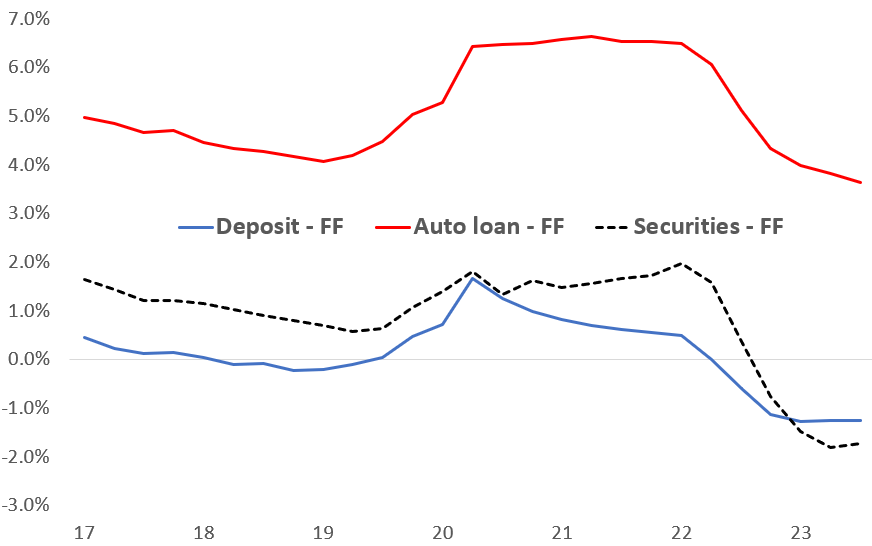

Neutral On Ally Financial Based On My 2025 EPS Forecast Math Seeking, No ssn and no credit score impact. Ally also offers banking products, home loans.

Ally Financial Infographic auto connected car news, Ally bank can be a good option for auto loan refinancing since you can get preapproved online and see which ally auto loan rates you qualify for. How to choose between auto approve and ally.

Ally Auto Loan review Top Ten Reviews, Ally bank can be a good option for auto loan refinancing since you can get preapproved online and see which ally auto loan rates you qualify for. Delinquency transition rates for mortgages.

Buy House Loan Calculator Ally Financial Auto Loan Rates, The fed raised rates through much of 2025, keeping auto loan rates high. Refinancing your vehicle with ally could help lower your monthly payment.

The Best Ally Financial Auto Loans Options Brand, What types of car loans does ally offer? The fed raised rates through much of 2025, keeping auto loan rates high.

Ally Auto Loan Review (2025) Is It a Good Option?, I highly suggest not getting an auto loan with ally. Ally also offers banking products, home loans.

31 Top Photos Ally Auto Apply For Loan Apply Online Auto Loans, No ssn and no credit score impact. The average new car loan rate now sits at 9.58% — “the highest we’ve seen for more than 20 years.” the average used car loan rate sits higher at 13.98%.

Ally Bank Auto Loans Is It Worth It in 2025? ️ YouTube, Finance amount must be between $1,000 and $300,000. Ally auto refinance, which is part of ally financial inc., is a direct lender that offers refinancing and lease buyout loans.

Ally Bank Stock Analysis How the Company will Thrive with Online Banking, Ally bank can be a good option for auto loan refinancing since you can get preapproved online and see which ally auto loan rates you qualify for. Refinancing your vehicle with ally could help lower your monthly payment.

Ally 2025 Auto Loan Refinancing Review Rates, Pros & Cons, Finance amount must be between $1,000 and $300,000. Consider refinancing your vehicle through ally to see if you qualify for a more affordable monthly payment or lower your interest rate.